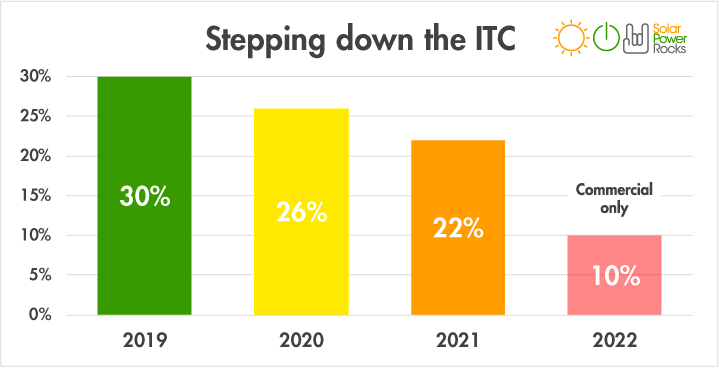

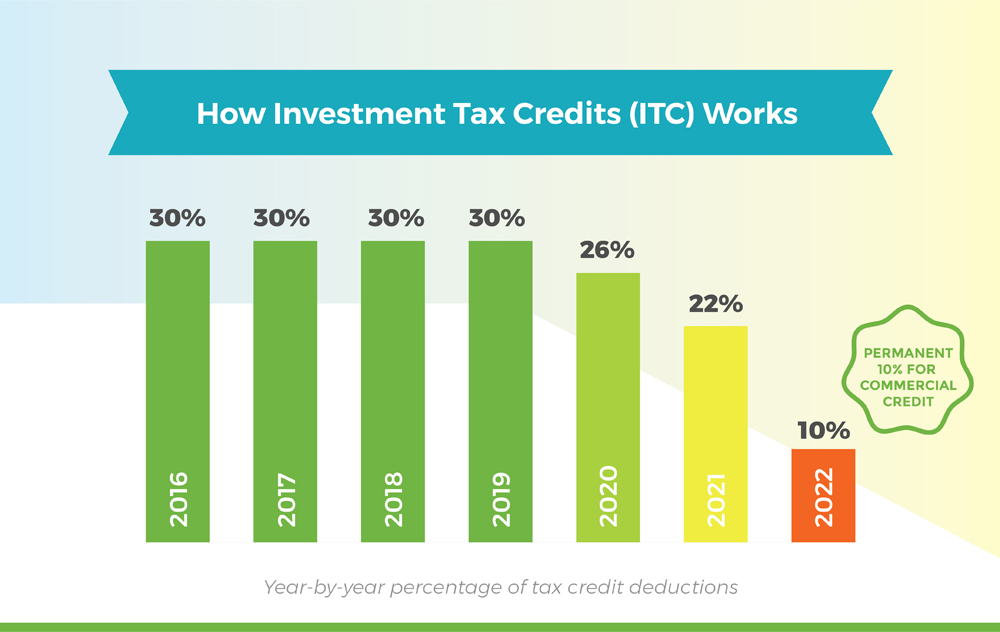

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

Solar energy credit carry forward.

Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property.

Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines and fuel cell property.

The federal solar energy tax credit is a tax credit that s available if you decide to install a solar system.

Yes the unused credit will carry forward to future years if you tax liability limits the amount this year.

The tax credit for the following items can be carried forward from the 2018 tax return to future years.

Solar powered hot water heaters.

For the non business energy property credit the carryforward period is 20 years.

With the residential energy efficient property credit taxpayers can carry forward the unused portion of the credit from the current year s tax return to the next year s tax return.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

If you have a carryover from 2018 you may claim the amount on the 2019 return and carryforward any unused amount to the following year.

My question is how many years can i carry forward the unused portion of the credit if my tax liability is not high enough to utilize it all in the first year.

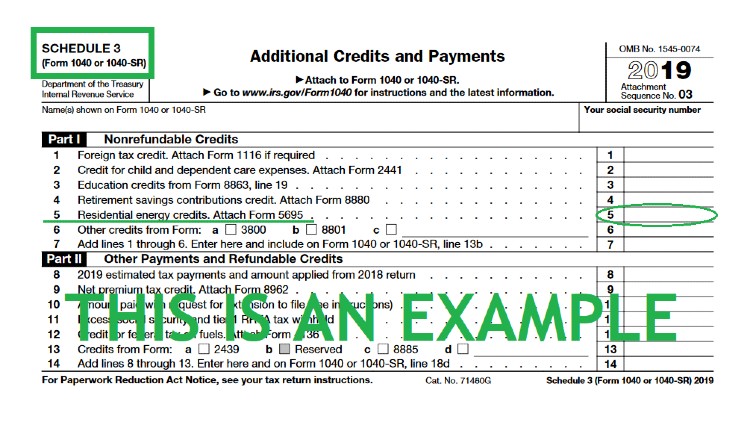

To claim the credit you must file irs form 5695 as part of your tax return.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

Filing requirements for solar credits.

The credit is applied to the following tax year so if you spend 10 000 on a new solar system you ll be able to take a.

I am looking to purchase a solar system for our house.

The solar investment tax credit itc is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic pv system that is placed in service during the tax year 1 other types of renewable energy are also eligible for the itc but are beyond the scope of this guidance.

You calculate the credit on the form and then enter the result on your 1040.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.